In this article, we will discuss the Azad Engineering share price target for 2024 to 2035, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

Quarter 1 Results

This company is about to release its Q2 financial report, the numbers indicate sound growth that is preconditioned by the company’s operational excellence and market strategies. Energy and Oil & Gas sectors emerged as the primary revenue generators for the company, and together, they provided 78.4% of total revenues. This impressive performance outlook is due to the strategic focus on contract acquisition and an increasing number of customers.

| Jun’24 (Cr) | YoY Change | QoQ Change | |

|---|---|---|---|

| Sales | 98.41 | 29.64% | 6.05% |

| Operating Profit | 33.04 | 26.04% | 5.38% |

| Net Profit | 17.12 | 131% | 14.7% |

Recent News

Among the critical successes of the company in Q2 is that the company made a large order of Rs 700 crore with Mitsubishi Heavy Industries. Not only do such contracts add to the revenue, but they also increase the goodwill of the company in critical sectors. That way, the successful implementation of the said contracts will fuel growth in the subsequent quarters.

Share price of the Azad Engineering jumped up +7.92% (Rs 1,577) on 4 Nov, 2024 from its previous close of Rs 1461. 52 week low of this company was Rs 642 and 52 week high was Rs 2,080.

Industry Overview

The key activities are provided in the aerospace, defense, energy, and oil & gas industries, where tremendous technological innovation and growing market demands are typical. Among all the industries, the aerospace industry is actually experiencing increased demand from individuals engaging in air travel as well as from countries’ defense movements.

There is also a rapidly changing picture of the world’s energy market as world economies shift towards more sustainable energies in addition to traditional oil and gas exploration. While this dual focus creates threats, such as vulnerability to shifts in the market supported by increased outsourcing of production, it opens avenues for firms, such as Azad Engineering, to manage its imperative for change with the continued delivery of high-quality output.

Company Overview

Initially established in 1983, it has created a specialized market as a manufacturer of forgings and precision machining. The aerospace and defense industry is one where the company has settled itself, playing essential roles in supplying parts for both military and civilian use. Azad Engineering owns four modern factories in Hyderabad spread across more than 20,000 sq. m.; advanced technologies allow it to satisfy the high requirements of international OEMs (Original Equipment Manufacturers).

A significant part of quality is the consistency of the certificates gained and the application of internationally recognized norms. Azad Engineering has established good end-user/supplier linkages with Honeywell Aerospace and other critical firms in the aerospace industry.

Azad Engineering Financial Statement

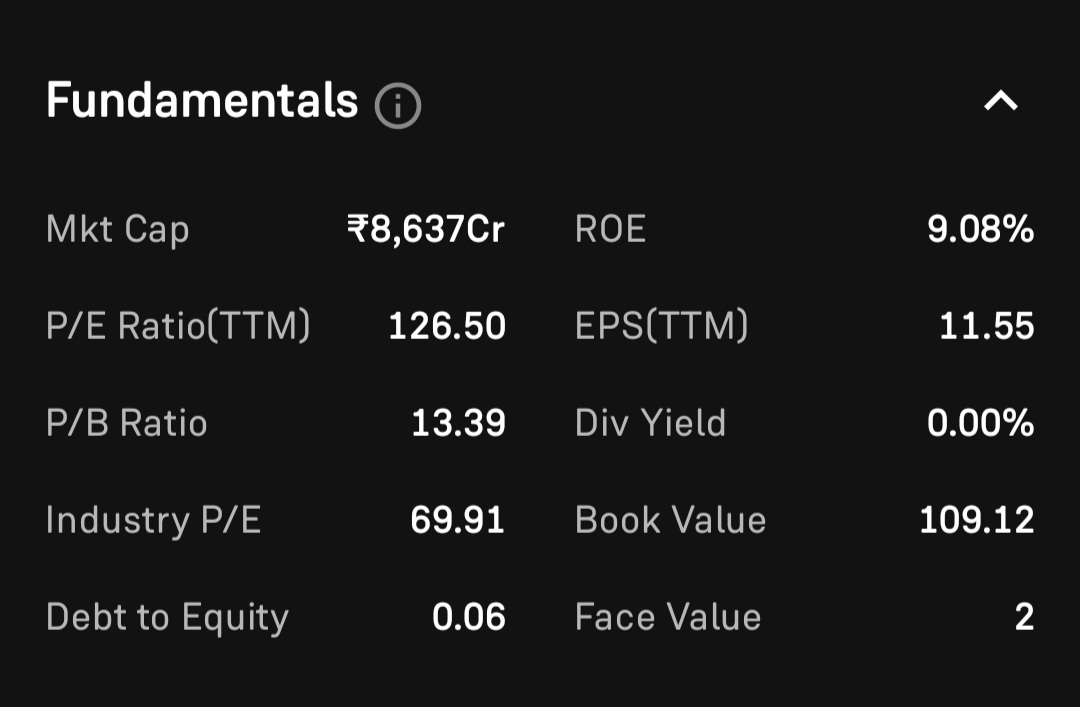

A thorough examination of Azad Engineering’s financials reveals several key metrics that highlight its current standing:

Market capitalization: Rs 8,642 crore

Current Stock Price: Rs 1,577

P/E ratio: 147

Book Value: Rs 109

Return on Capital Employed (ROCE): 19.9%

Return on Equity (ROE): 9.08%

Debt Status: Slightly leveraged, almost debtless, with a lower debt ratio.

These figures suggest that, although the company has a dominant position in the market and maintains profitability (thanks to a high ROCE), the P/E coefficient may be considered relatively high compared to the industry average. This has to be balanced with the company’s growth potential before any investor decides to invest the same.

Azad Engineering share price target for 2024

100% revenue of Azad Engineering comes from manufacturing high precision & original equipment manufacturers (OEMs) in the energy, aerospace and space. Its 12.5% business comes from India and rest 87.5% business comes from rest of the world.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 750 | 2,100 |

| 2nd Price Target | 840 | 2,140 |

Azad Engineering share price target for 2025

Azad Engineering has decreased its debt in Mar 24. In Q1 net profit was increased by 131% on year on year basis. Sales of Azad Engineering was increased by 29.64% on year on year basis.

| 2025 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 1,645 | 2,650 |

| 2nd Price Target | 1,750 | 2,880 |

Azad Engineering share price target for 2026

Net-profit is increasing QoQ from Rs 7.4 Cr in jun’23, Rs 14.93 crores in Mar’24, and Rs 17.12 crores in Jun’24.

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 2,255 | 3,560 |

| 2nd Price Target | 2,570 | 3,820 |

Azad Engineering share price target for 2030

Total 1.29 L shareholders was reported by the company in Sep’24 with 25.77% increase on QoQ basis.

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 5,540 | 6,410 |

| 2nd Price Target | 5,620 | 6,555 |

Azad Engineering share price target for 2035

The revenue of the firm depends mainly on the big orders from the customers. A delay or cancellation of an order would lead to a drastic effect on the company’s financial market situation.

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 8,850 | 9,503 |

| 2nd Price Target | 9,010 | 9,810 |

Strengths of Azad Engineering

Strong Order Book: The acquisitions illustrate that the company has recently bagged giant orders that prop up a healthy order book. The contract with Mitsubishi Heavy Industries is one good example of how strategic partnership improves financial positions.

Export Orientation: Azad Engineering has only around 9% of its product portfolio dependent on local market demand, which is helpful due to less vulnerability to fluctuations in demand for its products. It also limits risk linked to the economic slump in any of the targeted markets by diversifying its operations.

Technological Expertise: Its state-of-the-art technology assists the company in designing and developing superior-quality parts that conform to international standards. Apart from securing clients, such expertise leads to innovations within the organization.

Experienced Management Team: Proactively, the leadership team deployed to the firm has adequate experience cutting across the different sectors, enhancing decision-making and planning strategies.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Weakness of Azad Engineering

High Valuation Metrics: Its P/E ratio of 14 suggests that it trades at a somewhat higher multiple-to-book value compared to the industry average. It could discourage value seekers, the potential investors, because they will find it overpriced.

No Dividend Payments: Today, Azad Engineering has no provisions to distribute dividends to its shareholders, though the company makes profits. The absence of dividend payments could create a form of investment attractive to income investors seeking regular cash returns on investment.

Low Return on Equity: In particular, ROE at 12.1% shows that there is potential for increasing returns from equity investments subordinate. The managers of companies may try to enhance investors’ returns by improving the efficiency of capital structures.

Future Plans of Azad Engineering

Market Expansion: The company strives to increase its market share in aerospace and defense but also aims at venturing into other markets for its products. This includes going for diversification to other regions that have high potential markets for quality engineering solutions.

Technological Advancements: Such investments will remain the critical drivers for maintaining competitive advantages where research and development represent essential investments. Azad Engineering understands that there are continuous improvements on the technological front in order to address changing customer demand and conform to industry standards.

Long-term Contracts: Another way will be to continue signing long-term contracts with large, well-known players; this is with a view to having predictable cash flows. The company also intends to apply the lessons learned from the Mitsubishi Heavy Industries case by establishing analogous deals in other fields.

Sustainability Initiatives: In the future, as more and more people can become environmentally conscious, Azad Engineering should concentrate on incorporating sustainable manufacturing techniques and products, as the trend of sustainable manufacturing is on the rise in the current world.

Conclusion

The company Azad Engineering can be described as an exciting investment opportunity that can be strengthened by such factors as its realization of extensive collections of orders, huge technological capacities, and almost a predetermined lack of the company’s debts. Nevertheless, the higher valuation multiples should be taken with a pinch of salt by the potential investors when considering the growth prospects of the company. Like all industries, the aerospace and defense industries are also dynamic in nature, but for Azad Engineering, the opportunities and risks will remain inbuilt with the business.

The aerospace and energy industries remain high-growth industries and could attract investors interested in Azad Engineering’s stock, provided one was willing to take on certain risks implicated by valuation and reliance on specific contracts.

| Hind rectifiers share price target 2024 to 2035 | Read More… |

| Sagarsoft share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.

FAQs

Should one invest in Azad Engineering?

Although it has the appeal of steady contract wins and future growth opportunities, the hefty price tag requires investors to tread carefully.

Is Azad Engineering a multi-bagger?

Based on the current trend of operation and focused strategies of value creation, it is possible to consider this firm as a multi-bagger investment within the long-term time frame.

Who owns Azad Engineering?

Company ownership typically involves the founders and institutional investors, though specific names may differ due to fluctuations in the shareholding structure, as reported now and then.

Has Azad Engineering any debt?

Yes, the company is pretty much unlevered with markedly lower levels of debt compared to earnings potentiality.

What are the products of Azad Engineering?

Azad Engineering has concentrated its services on providing high-precision forged and machined products, especially in the aerospace, defense, energy, and oil & gas markets.