In this article, we will discuss the Prudent share price target for 2024 to 2035, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

Quarter 2 Results

Prudent Corporate Advisory Services Ltd. has declared its second-quarter results for the financial year 2024, which are phenomenal and have attracted investors and analysts across the world.

- Total revenue Rs 286 crore in Q2 FY24 as against of Rs 190 crore in Q2 FY23, increased with 50.54% YoY and 14.7% QoQ.

- Net Profit increased from Rs 51.52 crore in Q2 FY24 as against of Rs 30.42 crore in Q2 FY23, increased with 69.35% YoY and 16.56% QoQ.

- Operating Profit is reported Rs 68.75 crore increased 59.29% YoY and 16.56% QoQ.

- Earning per share (EPS) is reported 6.73.

| Sep’24 (Cr) | YoY Change | QoQ Change | |

|---|---|---|---|

| Sales | 286 | 50.54% | 14.7% |

| Operating Profit | 68.75 | 59.29% | 16.56% |

| Net Profit | 51.52 | 69.35% | 16.56% |

The announcement of such results caused the market to respond positively and sent Prudent’s stock to its 52-week high.

Industry Overview

Currently, the financial advisory market in India is rapidly developing, comprising a higher disposable income and a higher level of awareness regarding personal financial management, as well as the ever-expanding qualified middle class looking forward to availing of wealth management services from a financial consultant or advisor. Due to the increasing demand for professional financial advice such as investment, insurance, and retirement planning, establishments like Prudent will benefit from this trend.

The forecast trend indicates that the growth rate of the Indian financial services industry would be approximately 15 percent over the next five years, primarily due to the influence of digitalization and an enlarged customer base. It is pretty noticeable, especially in the segment of mutual funds, which, for example, has received record amounts of assets under management (AUM). This places firms that have favorable technological access and positioning in an excellent place to deliver well-individualized services that will allow them to capture the competitive market.

Company Overview

Mr. Sanjay Shah started Prudent Corporate Advisory Services in 2003, which offered mutual funds, insurance, wealth management services and solutions, and advisory services for retail and institutional clients. It has the policy of customer business and is well known for its high level of transparency in the work process.

Prudent is present through a network of branches across India, and the firm has an improved technological presence that aids the online interaction with the clients and delivery of services. Prudent has a market capitalization of about Rs 11,10383 crore, which makes the company one of the lead players in the Indian financial advisory industry.

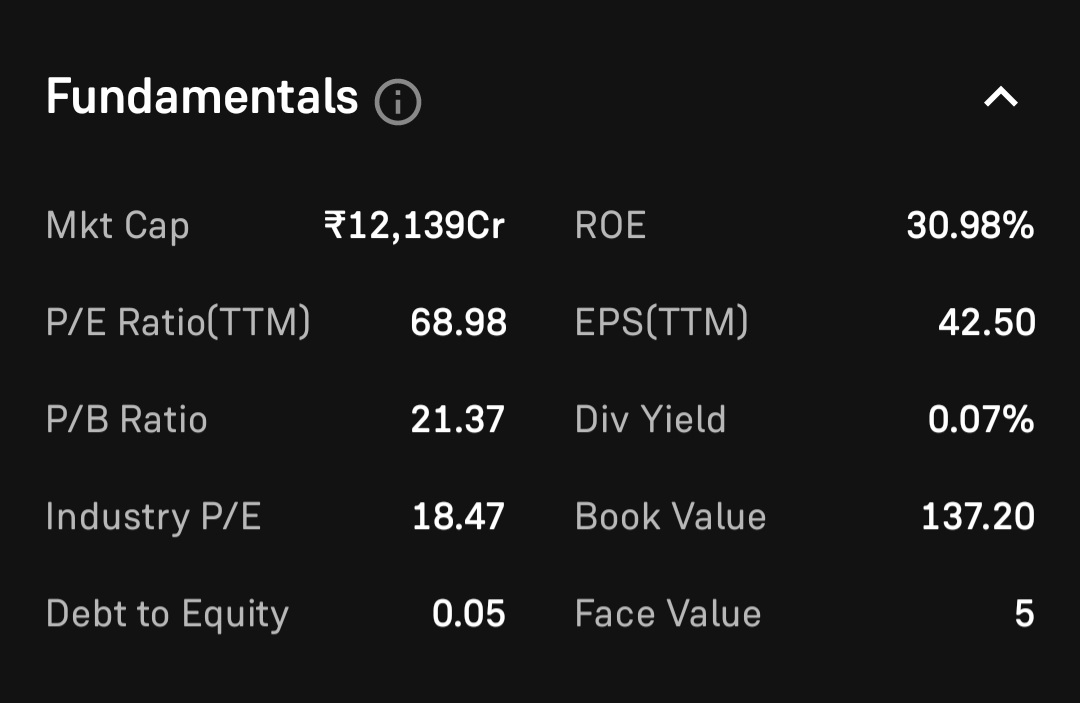

Financials of Prudent

To understand Prudent’s current position better, let’s delve into some key financial metrics:

Market capitalization: Rs 12,139 crore

P/E ratio: 68.98

EPS (TTM): Rs 42.50

Debt to Equity Ratio: 0.05

Return on Equity (ROE): 30.98%

Dividend Yield: 0.07%

These figures show that not only is Prudent expanding at an alarming rate, but it is also containing its overheads ideally. Thus, the situation when the debt-to-equity ratio is lower than one states efficient financial management and eliminates the high-risk level associated with the use of credit relations.

Prudent share price target for 2024

Total 100% of revenue company belongs to India. 82.28% revenue comes from distribution of mutual funds, 10.47% revenue from distribution of insurance, 2.93% from stock broking & allied services, and rest 4.32% is from other sources.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 1,150 | 3,465 |

| 2nd Price Target | 1,440 | 3,550 |

Prudent share price target for 2024 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 3550 and lowest price target 1150 in FY 2024.

Prudent share price target for 2025

Prudent has delivered more than 160% to its investors in last one year, more than 350% in last five years.

| 2025 | Lowest (Rs) | Highest (Rs) |

|---|---|---|

| 1st Price Target | 2,540 | 4,455 |

| 2nd Price Target | 2,720 | 4,650 |

Prudent share price target for 2025 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 2,540 and lowest price target 4,650 in FY 2025.

Prudent share price target for 2026

Mr. Sanjay Shah is the MD/CEO of Prudent. Promoters holding is decreased by 2.71%, currently remains 55.72% holding to promoters.

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 3,805 | 5,540 |

| 2nd Price Target | 4,010 | 5,865 |

Prudent share price target for 2026 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 5,865 and lowest price target 3,805 in FY 2026.

Prudent share price target for 2030

Talent Acquisition and Development matter is that the recruitment of a qualified human resource in the sphere of finance and information technology will be vital for the further growth and maintenance of the company’s market position.

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 12,540 | 14,505 |

| 2nd Price Target | 12,880 | 14,785 |

Prudent share price target for 2030 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 14,785 and lowest price target 12,540 in FY 2030.

Prudent share price target for 2035

Digital transformation has been accorded high consideration by Prudent through adopting new technologies that enhance organizational flow and the offering of services through improved service delivery platforms.

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 22,405 | 24,650 |

| 2nd Price Target | 23,110 | 25,205 |

Prudent share price target for 2035 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 25,205 and lowest price target 22,405 in FY 2035.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Strengths of Prudent

- Strong Financial Performance: Prudent has always displayed good sales growth and earnings capacity, which is the reason why investors interested in steady profitability should consider investing in the company.

- Low Debt Levels: Most importantly, Prudent possesses a low debt ratio that is only 0.04. Low debts are always an advantage to a business because they mean that the company is financially secure and that, in uncertain economic times, the company can never be at risk of bankruptcy due to lots of debts.

- Experienced Leadership: The company has executive professionals with adequate experience in finance and investment to give the much-needed strategic direction and execute the company’s mandate.

- Diverse Service Offerings: With the products and services, Prudent has all sorts of investment products, from mutual funds to insurance policies and wealth management services, which help retain the customers.

Weaknesses of Prudent

- High Valuation Metrics: The high P/E can lower stocks’ appeal to value investors; they look for stocks in the market that have a lower P/E than the market average.

- Market Volatility Sensitivity: Being a player in the financial service industry, Prudent faces challenges from the market forces within the international environment that affect the revenue from advisory services as well as asset management fees.

- Dependence on Economic Conditions: This means that the company’s performance is directly linked to other economic factors; a problem may reduce the number of clients and their investment in financial services.

- Limited International Presence: Up till now, Prudent has had a relatively better experience in India than some of the competitors who have also entered into international markets.

Future Plans of Prudent

Looking ahead, Prudent has outlined several strategic initiatives aimed at sustaining its growth trajectory:

- Expansion into New Markets: The company plans to expand in those unrecognized geographical zones in the country and the international market.

- Enhancing Digital Capabilities: More capital investment will be required in the future as Prudent aims at strengthening the application of technology to improve customer relations and the overall efficiency of organizations.

- Product Diversification: Similarly, while customers’ needs are constantly evolving, so are the products and services they are in need of; prudent aims to grow the existing number of its financial products through others that are relevant to the market and changing environment, such as climate-friendly investments or ESG funds.

- Strengthening Client Relationships: Due to the specialist’s value addition and the modern approach to customer care solutions, Prudent has an improved client relationship and an increased churn rate.

Conclusion

Out of all the listed companies, Prudent Corporate Advisory Services seems like one of the most promising candidates to invest in because of its high performance, efficient management team, and transparent development strategies targeting growth within the financial advisory industry that is constantly expanding in India. Though there might be some investors who may be worried about paying high multiples for some of these stocks, given the favorable projections on the industry and the firm’s earnings history and prospects, this may not be a bad bet for the long-term investor.

Portfolio managers need to consider the degree of risk that the company can undertake before it can be invested in and managed in a portfolio; however, the critical thing that should be understood is that Prudent has a high growth potential given the proper strategic position.

| Hind rectifiers share price target 2024 to 2035 | Read More… |

| Sagarsoft share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.

FAQs

Should one invest in Prudent stock?

Because Citigroup delivered great Q2 results and because the market sees its long-term potential even if its valuation multiples are rich, some people think it is ideal for long-term investors interested in the financial services industry.

Is Prudent a multibagger?

Substantial gains were seen over the prior year, in the vicinity of about 96%; future trends will be influenced by market and related factors as well as business implementation plans from then onwards.

Who is the owner of Prudent?

Sanjay Shah currently acts as the Managing Director of the company and contributes to its formation as well as the definition of the strategic development of the firm.

Is Prudent debt-free?

However, the company is not devoid of debts entirely and has a low d/e of 0.04, confirming that it minimally uses debt funds and hence is financially robust.

What has Prudent produced?

Some of the services that Prudent provides include mutual funds, insurance, wealth management, retirement planning, and complete services both to individual and corporate clients.