In this article, we will discuss the Sundaram Fasteners share price target for 2024 to 2035, fundamentals, future plans, and challenges depending on the various reports from research and brokerage firms and research analysts.

Quarter 2 Results

Sundaram Fasteners Limited, in its current quarter’s just declared second quarter of the current financial year, has posted multiple new relevant targets that signify operational supremacy. The company has declared interim dividend of Rs 3.00 per share for the FY 2024-25.

Key Financial Highlights:

Revenue Growth: Total revenue of company has increased to Rs 1,499 crore in Q2 FY24 from Rs 1,429 crore in Q2 FY23.

Net Worth Increase: Book net worth increased by 14.29% in this year up to this quarter compared to the same quarter of last year.

Operating Revenue: The total operating revenues crossed Rs 500 crore for the financial year ending March 2023.

These results are essential not only because they reveal the excellent financial position of the company but also because they show that this company can adapt to various problems arising from fluctuating market conditions and interruptions of the supply chain.

Industry Overview

Rising Vehicle Production: With the expansion of the global automobile market and its increased curiosity, especially in the growing economies next to the east to names such as India, there has been escalated demand for automobile parts.

Technological Advancements: The industry is experiencing rapid advancements in technology, such as in manufacturing technologies like the manufacture of high automation and digitization of production lines.

Shift Towards Electric Vehicles (EVs): The trend of electric vehicle adoption means continued change on the one hand and opportunity on the other hand for traditional vehicle parts manufacturers. Businesses are forced to design their products to fit new specifications and standards linked to electric vehicles.

Sustainability Trends: Currently, there is increased concern in the automotive industry on issues to do with sustainability, which has compelled manufacturers to develop more sustainable automotive parts.

It conversely presents a dynamic environment for Sundaram Fasteners while the company is establishing its operations and trying to capitalize on strengths while dealing with threats.

Company Overview

Sundaram Fasteners Ltd. was started in 1962, and it became a part of the TVS group, which is one of the largest automotive companies in India. The firm majors in the production of different kinds of parts, with the automotive industry being the primary market. Its product offerings include:

- High-tensile fasteners

- Cold extruded parts

- Automotive powder metal parts

- Water pumps

- Radiator caps

Having specified its focus on product quality and new product development, Sundaram Fasteners has carved a niche for itself as a reliable supplier for automotive majors not only in the domestic market but also the export market.

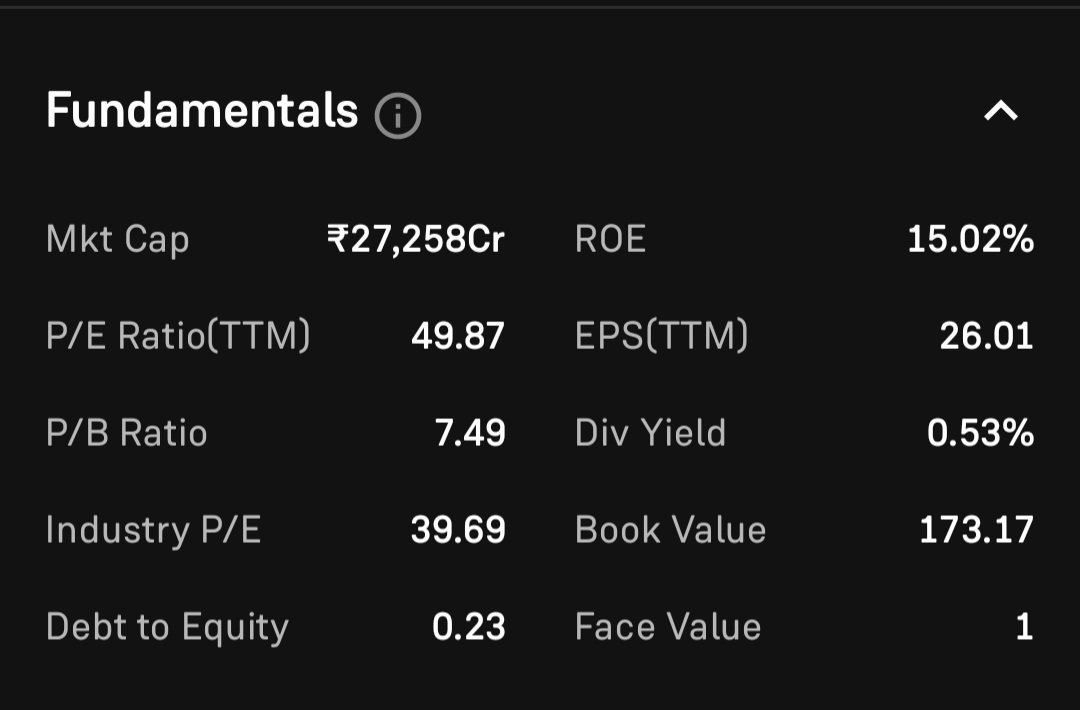

Financials of Sundaram Fasteners Ltd

Analyzing the financial health of Sundaram Fasteners provides insights into its operational efficiency and market position:

Current Price: Rs 1300.2

Market Cap: Rs 27,258 crore

PE Ratio: 49.87

EPS: Rs 26.01

52-week range: Rs 1003.05-Rs 1505.95

This circumstance is explained by the fact that income from operations depicts the company’s revenue growth while gross profit margin and operating margin reveal its profitability. The above facts mean that investors also have certain positive expectations towards future growth rates.

Sundaram Fasteners share price target for 2024

Sundaram Fasteners share price target for 2024 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 990 and lowest price target 1,580 in FY 2024.

| 2024 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 990 | 1550 |

| 2nd Price Target | 1010 | 1580 |

Sundaram Fasteners share price target for 2025

Sundaram Fasteners share price target for 2025 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 1,265 and lowest price target 1,885 in FY 2025.

| 2025 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 1265 | 1847 |

| 2nd Price Target | 1320 | 1885 |

Sundaram Fasteners share price target for 2026

Sundaram Fasteners share price target for 2026 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 1,624 and lowest price target 2,520 in FY 2026.

| 2026 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 1624 | 2450 |

| 2nd Price Target | 1685 | 2520 |

Sundaram Fasteners share price target for 2030

Sundaram Fasteners share price target for 2030 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 4,017 and lowest price target 4,920 in FY 2030.

| 2030 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 4017 | 4850 |

| 2nd Price Target | 4110 | 4920 |

Sundaram Fasteners share price target for 2035

Sundaram Fasteners share price target for 2035 is in bullish trend according to research analysts and brokerage firms, it may touch highest share price target Rs 6,503 and lowest price target 7,225 in FY 2035.

| 2035 | Lowest | Highest |

|---|---|---|

| 1st Price Target | 6503 | 7105 |

| 2nd Price Target | 6620 | 7225 |

Strengths of Sundaram Fasteners Ltd

Diverse Product Portfolio: It has a rich and varied portfolio that contains products that are appropriate for many areas within the automotive sector and diversifies risk by having little dependence on a single product.

Strong Brand Reputation: Sundaram Fasteners, being one of the leading auto-component suppliers to bigwigs of the auto industry, including GM and Tata Motors, enjoys a good standing when it comes to creditability.

Innovative Capabilities: Investing in research and development means that the company is well placed to make the needed changes that technological breakthroughs may make necessary.

Strategic Partnerships: This has a strong market affiliation with the top car makers, deepening the opportunity for growth due to shared ideas.

Robust Distribution Network: Having good distribution channels means that it can deliver its products to the customers in these areas on time.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Weaknesses of Sundaram Fasteners Ltd

High Dependence on the Automotive Sector: A good portion engages in automotive parts, meaning it is sensitive to changes in this industry due to economic difficulties and changes in taste and preference.

Limited Global Presence: It is positioned in India, where it has its most significant market share, but compared to rivals, it has a lower number of locations for expansion.

Cost Sensitivity: The automotive components industry is one of the most competitive industries around the globe, resulting in price cuts that may reduce margins if not well implemented.

Supply Chain Challenges: Concerning supply chain disruption, global supply chain interruptions can cause a change in meeting production timelines and growth of cost, hence profitability levels.

Future Plans of Sundaram Fasteners Ltd

Expansion into Electric Vehicle Components: Understanding the coming trends in the EV market to make Sundaram Fasteners a specific part of electric vehicles and potentially become a strategic part of the supply chain.

Geographical Expansion: The company is aiming to strengthen its export capacity by expanding its geographic presence beyond the current markets.

Investment in Technology Upgrades: Sustained investments in both the ICT infrastructure and manufacturing technologies shall further allow Sundaram Fasteners to achieve optimal performance, contain expenses on production, and preserve product quality.

Sustainability Initiatives: This approach correlates with the international tendencies to be environmentally friendly during production and may become a marketing advantage in the eyes of the buyer.

Strengthening R&D Efforts: The second strategy depends on research and development, which will enable Sundaram Fasteners to develop more products than its competitors.

Conclusion

This case makes Sundaram Fasteners Ltd. very attractive as an investment company since it is financially sound, has well-established operations, and strategically applies innovations and extensions to new markets like the EV markets. Although there are dangers in the reliance on the automotive industry and possible issues within the supply chain, the factors mentioned earlier have been planned for future growth.

Potential investors who want exposure in the automotive components segment may easily target Sundaram Fasteners due to good financials and an obvious strategy of embracing changes in the sector.

| Hind rectifiers share price target 2024 to 2035 | Read More… |

| Sagarsoft share price target 2024 to 2035 | Read More… |

FAQs

Is Sundaram Fasteners Ltd. an excellent stock to buy?

Experts opine that since the company has a robust balance sheet, the firm might be a good option for those who intend to invest in the future since the economic value of the EV sector appears promising.

Is Sundaram Fasteners Ltd. a multibagger?

In the past, this company recorded good returns, which pointed to the fact that there is room for expansion in the future, though this will be pegged on markets and efficient implementation of the strategies in the company.

Who is the owner of Sundaram Fasteners Ltd?

Sundaram Fasteners forms part of the TVS Group headed by T.V. Sundaram Iyengar, who envisioned, invested in, and shaped India’s automobile industry.

Does Sundaram Fasteners Ltd. have any debt to its credit?

Specifically, a current analysis of the company shows moderate levels of debt compared to its equity platform to enable it to make further fresh investments.

What are the products of Sundaram Fasteners Ltd.?

Sundaram Fasteners Ltd. Company primarily deals with two types of products, namely;

It also produces fastening systems, fasten automotive high-tensile fasteners, cold-created forms and shapes automobile automotive automobile water pumps, automobile radiator caps, etc.—high-tensile and ultra-precision automobile allied mechanical parts and others.

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.