In this article, we will discuss the Ircon International share price target for 2024 to 2035, the quarter 2 result, future plans, and challenges.

Ircon International is a prominent player in infrastructure projects, covering sectors like railway, civil engineering, and electrical works. The company is well known for fulfilling the complex infrastructure project in a strategic manner. This company operates in both domestic and international markets.

Stock Performance

Ircon International has given promising returns to its investors like

- -35% return in the last 6 months

- +13.23 percent returns in the last 1 year

- +213 percent returns in the last 2 years

- +302 percent returns in the last 3 years

- +333 percent returns in the last 5 years

Quarter 2 FY 25 Result

Ircon International has reported the following key financial results for the quarter ending September 30, 2024:

- Total sales reported Rs 2,447 crore in Q2 FY25 as against Rs 2,287 crore in Q1 FY24, increased with 7.01% QoQ and decreased with -19.31% YoY.

- Net profit increased to Rs 205 crore in Q2 FY25 as against Rs 224 crore in Q1 FY24, decreasing with -17.86% YoY and -8.07% QoQ.

- Operating profit is reported at Rs 200 crore in Q2 FY25, decreased by -23.36% YoY and -19.81% QoQ.

- Earnings per share (EPS) are reported at 2.15.

- Total number of shareholders increased by 156.69% YoY and 18.09% QoQ from 10.22L to 12.07L.

| Sep’24 (Cr) | YoY change | QoQ Change | |

|---|---|---|---|

| Sales | 2,447 | -19.31% | +7.01% |

| Operating Profit | 200 | -23.36% | -19.81% |

| Net Profit | 205 | -17.86% | -8.07% |

Company Overview

Ircon International Limited is a public sector infrastructure construction company based in India specializing in railway projects. Ircon has diversified its business into roads, buildings, airports, and metro rail works. This company is ISO certified and caters to domestic and international markets.

IRCON is completing its operations in several states in India and other countries like Malaysia, Nepal, Bangladesh, Afghanistan, the U.K., and recently Sri Lanka.

The company generates its 81.25% revenue from railways, 17.42% revenue from highways, 0.64% revenue from building, and 0.69% from others. Ircon International has 95.91% of its business from the Indian market and the rest 4.09% from the international market.

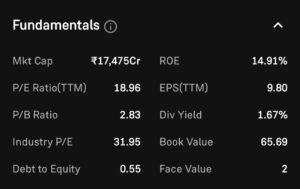

Financials

Market Cap – 17,475 Crore

P/E Ratio – 18.96

Industry P/E – 31.95

Debt to Equity – 0.55

Return on Equity – 14.91%

Dividend Yield – 1.67%

Ircon International’s 52-week high was Rs 351, and the 52-week low was Rs 157 per equity share.

Shareholding pattern

Ircon International has a shareholding pattern as of 30 Sep, 2024:

- Promoter holding is 65.17%, which is decreased by -8.01% year-on-year.

- Foreign institutions have a 3.94% holding, reduced by -0.23% year-on-year.

- Domestic institutions have a 1.42% holding, increased by +1.1% YoY.

- Retail participation has increased to 25.56% from 23.41%, increased by 8.08% YoY.

- The total number of shareholders has increased YoY with 156.69% to 12.07 L from 10.22 L.

Ircon international Share Price Target 2024

The share price target of Ircon International is expected to witness a bullish trend in the year 2024, with the maximum share price Rs 355 in FY 24. The growth percentage for Ircon International shares is predicted to be negative, with an downward trend towards the end of the year.

- Project expansion and diversification: Ircon International is consistently on its business expansion in various sectors like railways, roads, and highways. The company is capable of completing high-value projects domestically and internationally.

Ircon International Share Price Target 2025

The share price target of Ircon International is expected to witness a bullish trend in the year 2025, with the maximum share price Rs 510 in FY24. The growth percentage for Ircon International shares is predicted to be positive, with an upward trend towards the end of the year.

- Research and development: Ircon International is focusing on research and development consistently for completing their long-term projects in the given time frame.

Ircon International Share Price Target 2030

The share price target of Ircon International is expected to witness a bullish trend in the year 2030, with the maximum share price Rs 1225 in FY30. The growth percentage for Ircon International shares is predicted to be positive, with an upward trend towards the end of the year.

- Project Delay Problem: Ircon International is currently facing the project delay problem. The environmental crisis, ministry clearance, and land acquisition delay are responsible factors for delaying long infrastructure projects.

Ircon International Share Price Target 2035

The share price target of Ircon International is expected to witness a bullish trend in the year 2035, with the maximum share price Rs 3251 in FY35. The growth percentage for Ircon International shares is predicted to be positive, with an upward trend towards the end of the year.

- Economic Slowdown: Financial crises in the economy can reduce the infrastructure projects, so economic slowdown may be a risk factor in a company’s growth.

Conclusion

Ircon International has a broader vision to become a global leader in the infrastructure development sector, domestic and internal markets. Ircon International is focusing on revenue growth, with a forecast of Rs 1,15,445 million by FY2026.

The Indian government is working on a separate rail line for the fast delivery of goods. Market analysts have a positive outlook for Ircon International while correction in last 6 moths may look as investment opportunity.

| Hind rectifiers share price target 2024 to 2035 | Read More… |

| Gland Pharma share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not an investment advice.