Orient Tradelink share price target 2024 to 2030 and quarter 2 FY 2025 is discussed below, based on the market research analyst and brokerage firm reports.

Orient Tradelink Ltd. was incorporated in 1994 and is based in Hong Kong and currently concentrates on the media & entertainment industry, particularly in the production and distribution of motion pictures, animated movies, television serials, and song albums.

The firm is ranked as a small-cap company due to its market capitalization of around Rs 19.22 crore. In the case of Leads India, the head office is in Ahmedabad, Gujarat. With time, Orient Tradelink has diversified its activities in various entertainment projects and has recently entered into the merchandising business, which consists of more than 2000 hours of spiritual and sports HTML and several Sai Baba products.

Quarter 2 Results

Orient Tradelink Ltd. reported its financial results for the second quarter of FY25, ending September 30, 2024:

- Net Profit: Net profit reported in Q2 FY 25 0.54 crore, up from Rs 0.17 crore net profit in the corresponding period of the last year, the company has registered quite a turnaround.

- Revenue from Operations: Increased to Rs 3.07 crore in Q2 FY25 from Rs 1.99 crore in Q2 FY24, evidencing a year-on-year (YoY) growth of 54%.

- EBITDA: Consolidated EBITDA was Rs 1.06 crore, and its operating profit margin was at 12.75% during the year, while it was negative in the previous year.

- Profit Before Tax: It is reported at Rs 0.75 crore, whereas the company has incurred a loss of Rs 0.15 crore in Q2 FY24, which indicates the signs of revival rather strongly.

- Earnings Per Share (EPS): Improved to Rs 0.22 from a loss of Rs 0.07 in the same quarter of the prior fiscal year.

| Financial Metric | Q2 FY25 | Q2 FY24 | Year-on-Year Change |

| Net Profit | 0.56 crore | 0.17 crore | +566.67% |

| Revenue from Operations | 3.07 crore | 1.99 crore | +51% |

| EBITDA | 1.06 crore | -0.20 crore | +630% |

| Profit Before Tax | 0.75 crore | 0.22 crore | +350% |

| Earnings Per Share (EPS) | 0.22 | 0.07 | +560% |

Financial Performance

The financial ratios of Orient Tradelink indicate a moderate performance scenario. The PE ratio of the company stands at around -82.01, meaning it is not currently earning a profit per its share price.

The Price to Book (PB) ratio is pegged at 1.42, which means the stock is currently priced in the While UHL has reported higher revenue of 302.75% quarter-over-quarter, the company remains unprofitable and shows negative EPS of Rs 0.0897 and 2.33% ROA123.

| Small Rubber Company turned Rs 1 lakh into approximately 1 crore 11 lakh | Read More… |

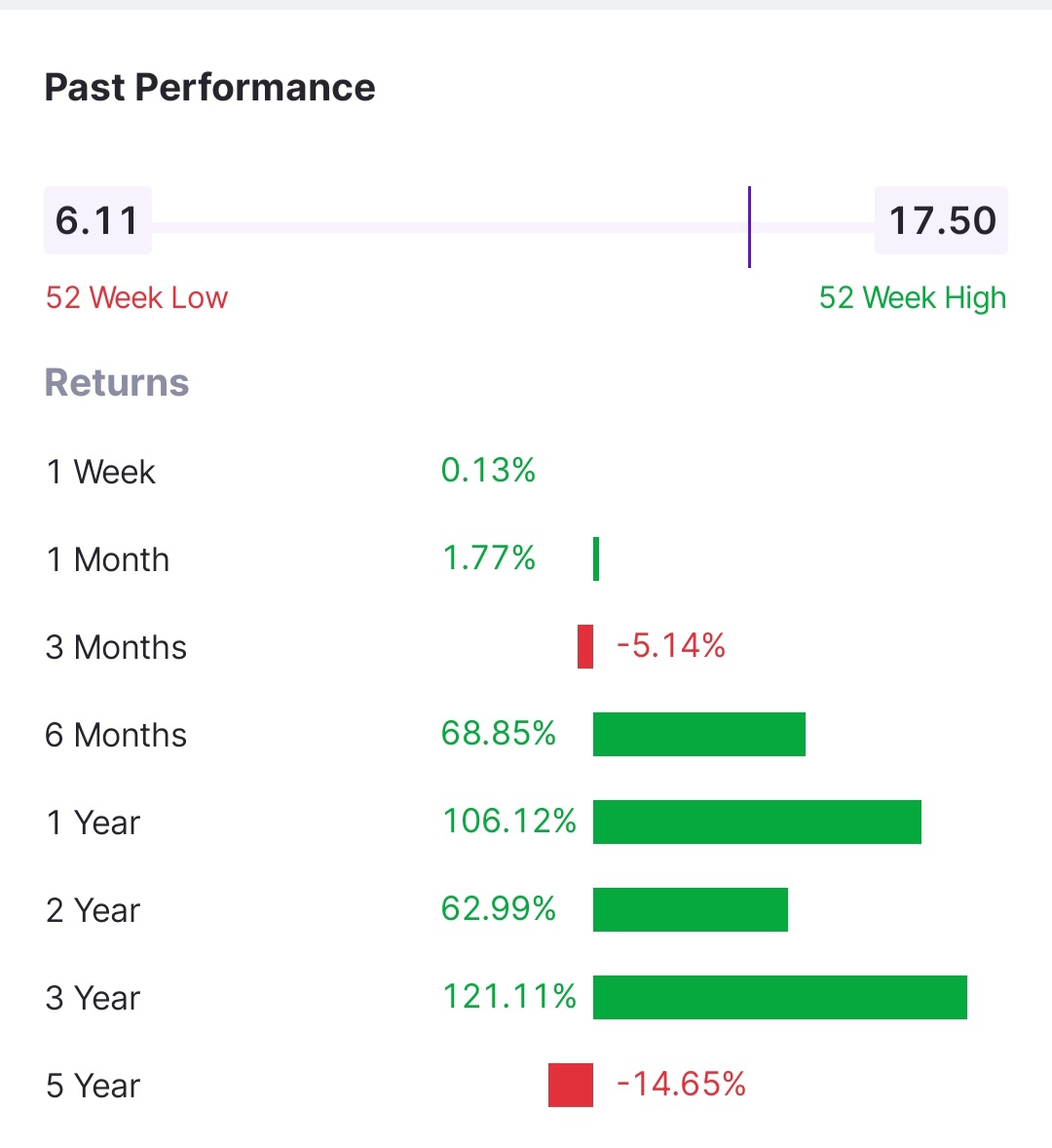

Orient Tradelink chart pattern

Orient Tradelink Share Price Target 2024 to 2030

Share price targets for Orient Tradelink are highly speculative and influenced by numerous factors, such as market conditions, economic indicators, company performance, industry trends, and many more. We will predict for the Orient Tradelink share price target in 2024 to 2030 by analyzing the previous performance and after studying various brokerage and research firm forecasts.

| Year | Share Price |

|---|---|

| 2024 | 18.10 |

| 2025 | 28.40 |

| 2026 | 40.20 |

| 2027 | 55.54 |

| 2028 | 85.36 |

| 2029 | 120.63 |

| 2030 | 150.55 |

Orient Tradelink Share Price Target 2024

The share price of Orient Tradelink is expected to continue experiencing volatility throughout the year, with a maximum price target of Rs 18.10 in FY 2024 and a minimum price target of Rs 6.17 in FY 2024. The average price target for Orient Tradelink in 2024 is expected to be around Rs 12.55.

Orient Tradelink Share Price Target 2025

The share price of Orient Tradelink is expected to continue experiencing volatility throughout the year, with a maximum price target of Rs 150.55 in FY 2025 and a minimum price target of Rs 120.55 in FY 2025. The average price target for Orient Tradelink in FY 2025 is expected to be around Rs 135.33.

Orient Tradelink Share Price Target 2030

The share price of Orient Tradelink is expected to continue experiencing volatility throughout the year, with a maximum price target of Rs 128 in FY 2030 and a minimum price target of Rs 70 in FY 2030. The average price target for Orient Tradelink in 2030 is expected to be around Rs. 105.

| Waaree Energies Q2 FY25 Result Update and Future plans | Read More… |

Future Plans

As for future development, Orient Tradelink is planning to strengthen its recently developed merchandising business, as well as to broaden the spectrum of its content. Through new developments, the company expects to achieve revenue growth of 30% in the next financial year, 2024-25, by focusing on distinct operations such as spiritual and sports content distributions and new products added on the basis of the most famous themes.

Furthermore, increasing operational efficiency and cost control will remain crucial to increasing profit margins and ensuring sustainable development in the growing competitive market.

Challenges

Currently, Orient Tradelink has some threats that may affect its future results. Initially, a move from a profitable to a loss-making firm does question the operational structure and the control over costs that the firm has.

Additionally, a high PE ratio implies that the stock may be overvalued and that investor interest quickly dissipates if results do not continue to be satisfying. Furthermore, the ever-demanding nature of the competing media production industry and a constant quest for quality and audience involvement are still concerns that need strategic vision and creativity.

Orient Tradelink stock performance

| Orient Technologies share price target 2024 to 2035 | Read More… |

| Avalon Technologies share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.