In this article, we will discuss the Premco Global share price target for 2024 to 2035, the quarter 2 result, stock performance, future plans, and challenges based on various research reports.

Premco Global Ltd. is a leading manufacturing company in textiles and apparel, specializing in narrow fabrics, tapes, & webbing. Originally a woven narrow fabrics manufacturer established in 1986, the firm adopted suppliers of critical materials to famous worldwide apparel makers.

Being company-oriented in quality and productivity, Premco has diversified into other areas and invested in Queensland production and manufacturing facilities as well as new technology systems for production.

The company has several facilities and has an environmental concern, hence working towards having environmentally friendly production processes to meet the growing production of textiles.

Q2 FY 25 Results

For the second quarter of FY25, Premco Global reported impressive financial results:

- Net Profit: Reduced to Rs 1.79 crore in Q2 FY 25 from Rs 2.13 crore for the same period of the previous year, down by 15.96%.

- Revenue from Operations (Sales): Borrowing costs rose slightly to Rs 25.97 crore in the second quarter for the financial year ending 2025 from Rs 24.01 crore in the corresponding period in the previous year, rising by 8.17% YoY.

- Profit Before Tax (PBT): Reduced to Rs 2.23 crore in Q2 FY25 from Rs 2.71 crore in Q2 FY24, showing YoY decline of 17.71%.

- Earnings Per Share (EPS): Decreased to Rs 5.42 billion in Q2 FY25 compared to Rs 6.45 billion in Q2 FY24, down by 15.97%.

| Financial Metric | Q2 FY25 (Cr) | Q2 FY24 (Cr) | Year-on-Year Change (%) |

| Net Profit | 1.79 crore | 2.13 crore | -15.96% |

| Sales | 25.97 crore | 24.01 crore | +8.17% |

| Profit Before Tax | 2.23 crore | 2.71 crore | -17.71% |

| Earnings Per Share (EPS) | 5.42 | 6.45 | -15.97% |

Financial Performance

The financial position of Premco Global for Q2 FY25 demonstrates that total revenues have been boosted by huge margins, mainly backed by higher customer traffic to its products and services and efficient management of costs.

The marked increase in the revenue and the net profit confirms the company is timely exploiting the available market opportunities as it executes its operations effectively.

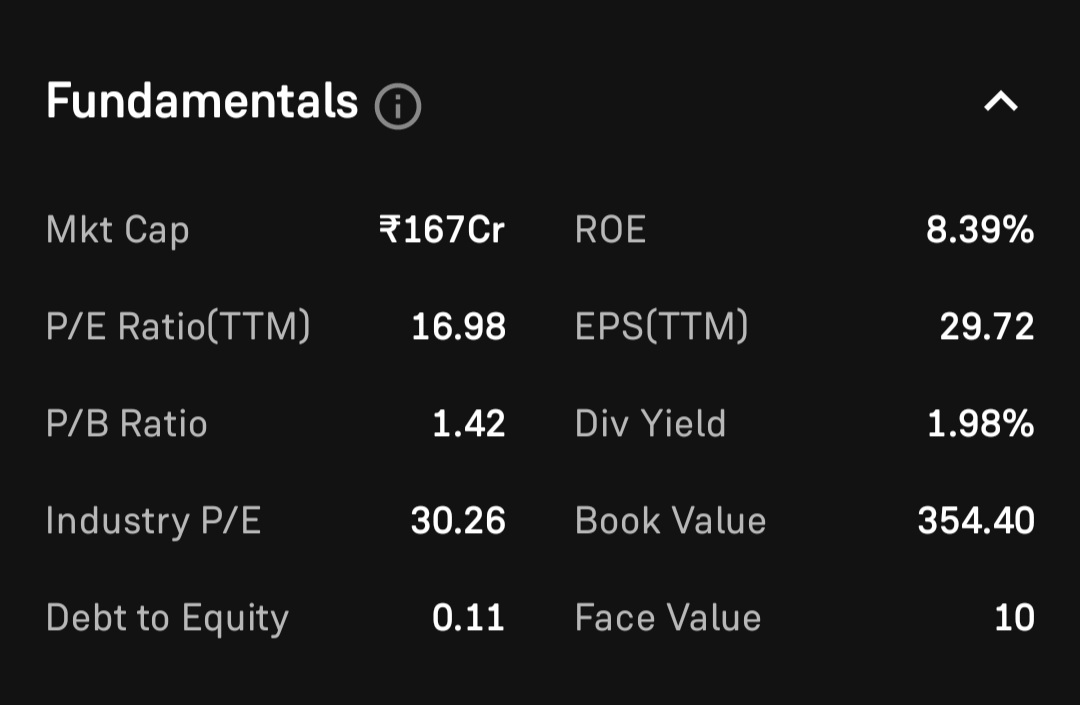

Market Cap – 167 crore

P/E Ratio – 16.98

Industry P/E – 30.26

Debt to Equity – 0.11

Return on Equity – 8.39%

Dividend Yield – 1.98%

Premco Global’s 52-week high was Rs 645, and the 52-week low was Rs 360 per equity share.

Stock Performance

Premco Global has given good returns to its investors, given below:

+18.27 percent return in the last 6 months

+20.16 percent returns in the last 1 year

+54.02 percent returns in the last 2 years

+2.93 percent returns in the last 3 years

+309.83 percent returns in the last 5 years

Shareholding Pattern-

Premco Global has a shareholding pattern as of 30 Sep, 2024:

- Promoter holding is 66.98%.

- Foreign institutions have a 0.0 percent holding.

- Retail participation is 14.99 percent, decreased by -1.92% YoY and increased by 0.95% QoQ.

- The total number of shareholders has decreased by -3.34% to 2,517 from 2,574.

Premco Global Share Price Target 2024

The share price target of Premco Global is expected to witness a bullish trend in the year 2024, with the avg share price of Rs 530 in FY 2024. The growth percentage for Premco Global shares is predicted to be positive, with an upward trend towards the end of the year due to strong quarter results.

Market Expansion: The specific global market segments Premco wants to target include the export market to expand the exporting sector in the company and to seek partnerships with international brands.

Premco Global Share Price Target 2025

The share price target of Premco Global is expected to witness a bullish trend in the year 2025, with the maximum share price Rs 950 in FY 2025. The growth percentage for Premco Global shares is predicted to be positive, with an upward trend towards the end of the year.

Research and Development: On this front, Premco will commit resources towards R&D to come up with new and improved textiles that meet such qualities that consumers are likely to accept in the future and any new trends likely to develop in the near future.

Premco Global Share Price Target 2030

The share price target of Premco Global is expected to witness a bullish trend in the year 2030, with the maximum share price Rs 2,246 in FY 2030. The growth percentage for Premco Global shares is predicted to be positive, with an upward trend towards the end of the year.

Raw Material Price Volatility: Sudden changes in the face values of raw materials will affect the cost of manufacturing and profitability.

Premco Global Share Price Target 2035

The share price target of Premco Global is expected to witness a bullish trend in the year 2035, with the maximum share price Rs 4,604 in FY 2035. The growth percentage for Premco Global shares is predicted to be positive, with an upward trend towards the end of the year.

Intense Competition: Competition is stiff, bearing in mind that the textile industry is enormous, which means that products must be differentially created and improved constantly.

Future Plans

- Capacity Expansion: Further, Premco Global has also identified an increase in the capacity of production through the procurement of new machines and technologies to cope with the increasing demand.

- Product Diversification: It intends to bring new product categories into the market, organic textiles and fabrics, and innovative fabrics.

- Sustainability Initiatives: The responsibility of sustainability is an essential factor in the company, and efforts are being made towards implementing sustainable practices in an organization, such as minimization of waste and energy conservation.

Challenges

- Regulatory Compliance: Observing the environmental laws and policies, as well as the standard labor laws, presents specific difficulties that have to be confronted.

- Supply Chain Disruptions: This may have a direct impact on the supply chain, where access to some materials necessary in producing some products might be a challenge and/or delivery of these products might be delayed.

- Changing Consumer Preferences: Due to fluctuating fashion and consumer preferences, frequent shifts in the production and distribution systems are expected.

Conclusion

The consistent performance demonstrated by Premco Global Ltd. for Q2 FY25 is the function of its related strategic management and quality focus in textiles. However, the existing issues the firm deals with comprise raw materials price fluctuations, competitive pressures, and product differentiation, which can be addressed as the company is already planning for continued growth, product evolution, and green development.

Consequently, innovation and customer-oriented value proposition offer Premco Global a sound strategy to solidify its market position further and ensure lasting growth moving forward.

| Hind rectifiers share price target 2024 to 2035 | Read More… |

| Gland Pharma share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not an investment advice.