Vuenow Infratech share price target 2024 to 2030 and quarter 2 FY 2025 is discussed below, based on the market research analyst and brokerage firm reports.

Vuenow Infratech Ltd. was incorporated in 1993, offering data center & infrastructure solutions in India. Formerly called Good Value Irrigation Ltd., the company has plied its trade from manufacturing irrigation systems to delivering the new-age data control system.

Vuenow is in the business of providing colocation services, cloud services, and data center solutions for enterprise needs as the demand for data management increases. It operates out of Mumbai and has pledged to bring new solutions to the Indian market, such as its recently launched Quantum Secure Data Centre, which uses cutting-edge encryption techniques to protect clients’ data from the latest and increasing threats.

Quarter 2 Results

Vuenow Infratech Ltd reported its financial results for the second quarter of FY25, ending September 30, 2024:

- Net Profit: This rose by Rs 3.89 crores to Rs 0.20 crores in the same quarter of the prior year, showcasing a year-on-year growth.

- Revenue from Operations: Rising to Rs 13.24 crore from Rs 3.47 crore in Q2 FY24, this represents a YoY growth rate of 138%.

- EBITDA: Consolidated EBITDA on this revenue level was Rs 5.29 crore, and its operating profit margin was 39.9% against the prior year’s 14.1%.

- Profit Before Tax: Priced at Rs 5.19 crore, up from Rs 0.91 crore in Q2 FY24, indicates a good rebound.

- Earnings Per Share (EPS): Raised to Rs 1.68 from Rs 0.39 in this quarter of the immediate past financial year.

| Financial Metric | Q2 FY25 | Q2 FY24 | Year-on-Year Change |

| Net Profit | 3.89 crore | 0.79 crore | +392% |

| Revenue from Operations | 13.24 crore | 5.55 crore | +138% |

| EBITDA | 5.29 crore | 0.97 crore | +445% |

| Profit Before Tax | 5.19 crore | 0.91 crore | +471% |

| Earnings Per Share (EPS) | 1.68 | 0.39 | +330% |

Financial Performance

These figures reflect expansion in almost all aspects, better highlighted by its current second quarter FY25 results from Vuenow Infratech occasioned by a push for data center services and unique products such as Quantum Secure Data Centre.

The substantial increase in the figure of revenue can be attributed to the experience that the company has gained in acquiring and maintaining. Net profit has also increased dramatically; this depicts efficient management of costs and operations.

The business has maintained high profitability by having an EBITDA margin of 39.9% based on revenues; such an excellent standing places New Vuenow well in the realm of data management services competition.

Vuenow Infratech share price target 2024 to 2030

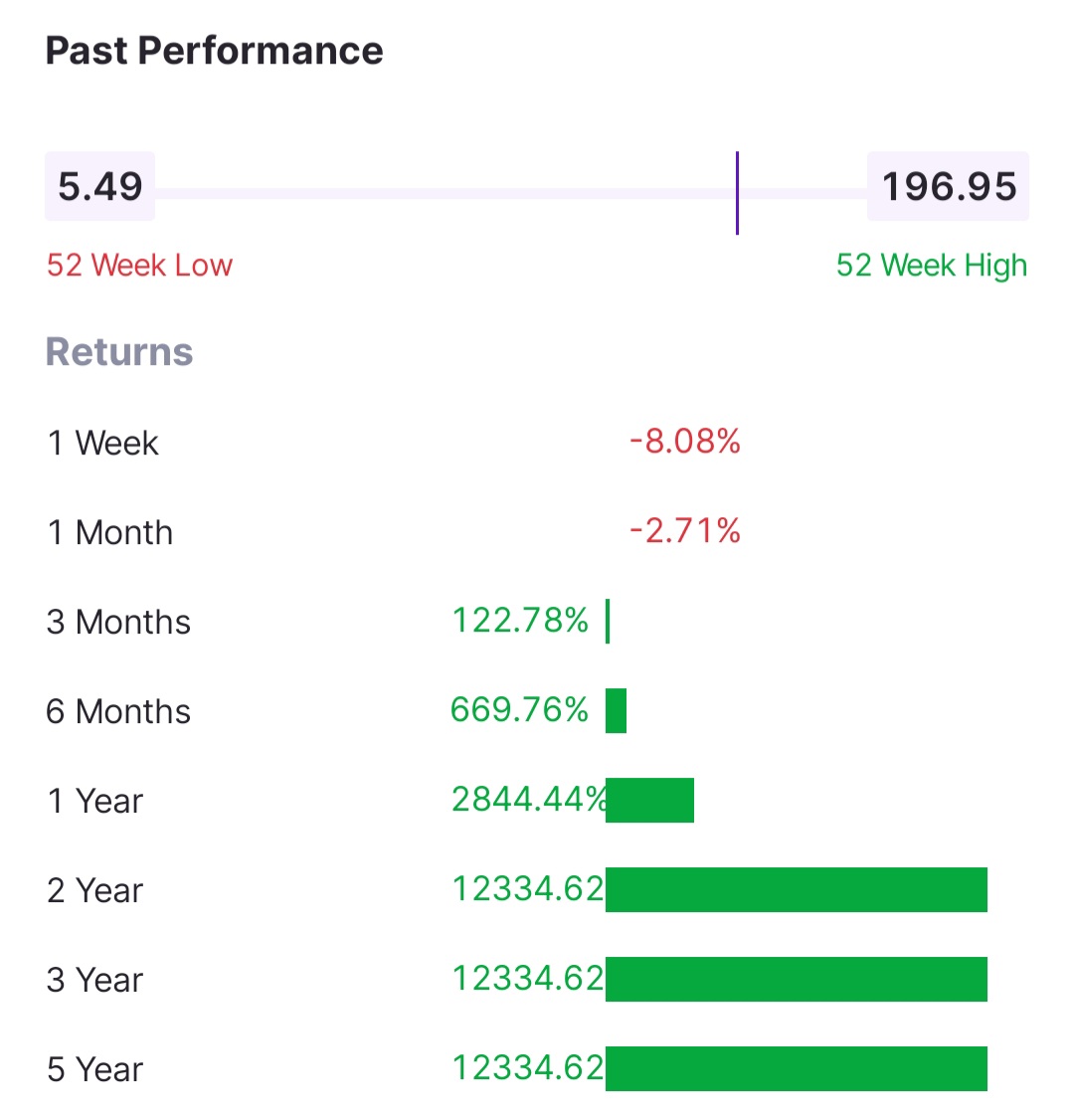

Share price targets for Vuenow Infratech are highly speculative and influenced by numerous factors, such as market conditions, economic indicators, company performance, industry trends, and many more. We will predict the Vuenow Infratech share price target in 2024 to 2030 by analyzing the previous performance and after studying various brokerage and research firm forecasts.

| Year | Share Price |

|---|---|

| 2024 | 180 |

| 2025 | 400 |

| 2026 | 765 |

| 2027 | 1,370 |

| 2028 | 2,120 |

| 2029 | 4,385 |

| 2030 | 7,540 |

Vuenow Infratech Share Price Target 2024

The share price of Vuenow Infratech is expected to continue experiencing volatility throughout the year, with a maximum price target of Rs 180 in FY 2024 and a minimum price target of Rs 5 in FY 2024. The average price target for Vuenow Infratech in FY 2024 is expected to be around Rs 145.

Vuenow Infratech Share Price Target 2025

The share price of Vuenow Infratech is expected to continue experiencing volatility throughout the year, with a maximum price target of Rs 400 in FY 2025 and a minimum price target of Rs 150 in FY 2025. The average price target for Vuenow Infratech in FY 2025 is expected to be around Rs 265.

Vuenow Infratech Share Price Target 2030

The share price of Vuenow Infratech is expected to continue experiencing volatility throughout the year, with a maximum price target of Rs 7,540 in FY 2030 and a minimum price target of Rs 3564 in FY 2030. The average price target for Vuenow Infratech in 2030 is expected to be around Rs 5645.

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Future Plans

Therefore, in the future, Vuenow Infratech plans to strengthen its position in the market by improving its services and adopting advanced technologies. To further its growth strategy, the company wants to strengthen its Quantum Secure Data Centre business as it targets a growing demand for high-security services in different industries such as financial and medical.

Also, Vuenow is actively seeking opportunities to partner and develop collaboration with other firms to support its technological agenda and expand the circle of its clients internationally.

Sustainability strategy is also considered by the company, its goal being to minimize its negative impact on the environment and provide outstanding services at the same time.

Challenges

Nevertheless, there are lots of challenges that Vuenow Infratech has to cope with at the moment, which may influence further development. To avoid potential risks that quantum technologies might pose, cybersecurity threats are likely to change rapidly; thus, constant reinvestment in security technologies is essential.

In addition, contests in the data center sector are rising because the number of competitors is likely to grow, which contributes to the pressure on prices and margins.Further, legal requirements on data protection laws are constantly evolving, hence leading to many challenges of a regulatory nature that must be effectively managed and addressed while seeking means to optimize operational effectiveness.

Vuenow Infratech stock performance

| Orient Technologies share price target 2024 to 2035 | Read More… |

| Avalon Technologies share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not investment advice.