In this article, we will discuss the Oriental Rail share price target for 2024 to 2035, the quarter 2 result, future plans, and challenges based on various research reports.

Oriental Rail Infrastructure Limited (ORIRAIL) is a small-cap company that engages in manufacturing and distributing a range of wood-based decorative products, including wood and decorative laminates, compreg boards, and veneers.

Stock Performance

Oriental Rail has given good returns to its investors, given below:

-17.32% return in the last 6 months

+86.61 percent returns in the last 1 year

+84.47 percent returns in the last 2 years

+56.01 percent returns in the last 3 years

+320.65 percent returns in the last 5 years

Quarter 2 FY 25 Result

Oriental Rail has reported the following key financial results for the quarter ending September 30, 2024:

- Total sales reported Rs 186 crore in Q2 FY25 as against Rs 115 crore in Q2 FY24, increased with 62.18 percent YoY and increased with 51.26% QoQ.

- Net profit increased to Rs 10.46 crore in Q2 FY25 as against Rs 7.69 crore in Q2 FY24, increasing with 36.04% YoY and 78.59% QoQ.

- Operating profit is reported at Rs 21.40 crore in Q2 FY25, increased by 27.92% YoY and 53.61% QoQ.

- Earnings per share (EPS) are reported at 2.15.

- The total number of shareholders increased by 245.2% YoY and 29.29% QoQ, from 27,408 to 35,435.

Revenue

The company generates its 82.7% revenue from seat and birth, 7.64% revenue from coated upholstery fabric, 3.32% revenue from phenolic resin and hardener, and 2.43% from compreg board & articles thereof, and the rest 1.59% from plywood. Oriental Rail has 100% of its business from the Indian market.

Financials

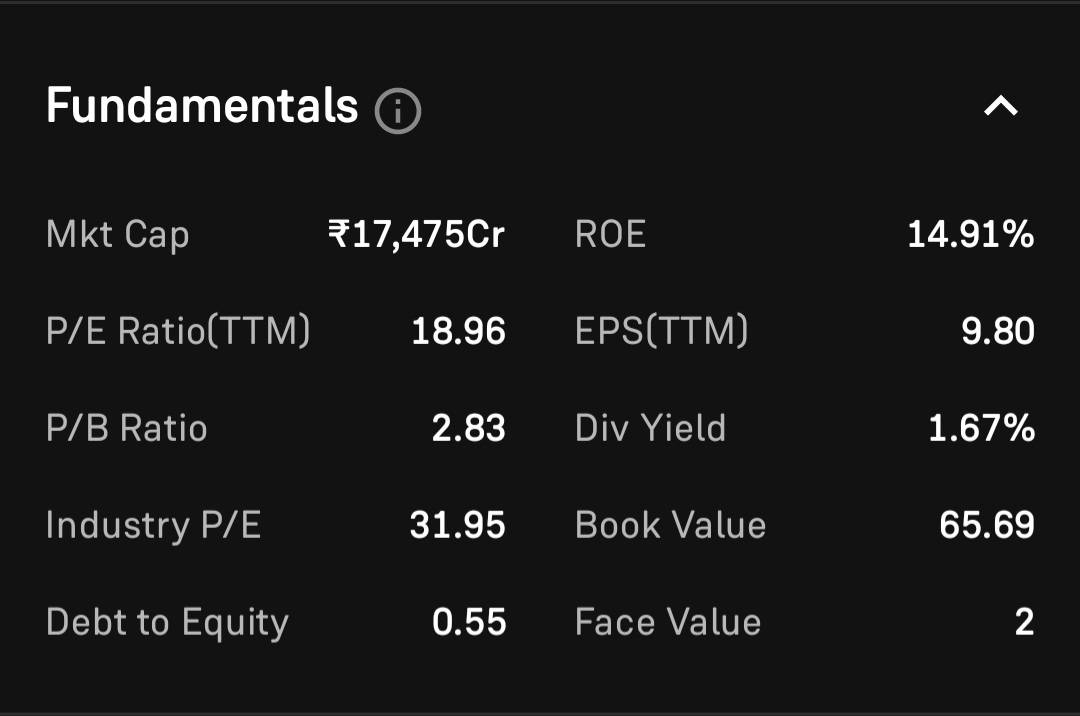

Market Cap – 17,475 crore

P/E ratio – 18.96

Industry P/E – 31.95

Debt to Equity – 0.55

Return on Equity – 14.91%

Dividend Yield – 1.67%

Oriental Rail’s 52-week high was Rs 445, and the 52-week low was Rs 120 per equity share.

Shareholding pattern

Oriental Rail has a shareholding pattern as of 30 Sep, 2024:

- Promoter holding is 54.81%, which is decreased by -3.04% year-on-year.

- Foreign institutions have a 0.33 percent holding, increased by 0.33% year-on-year.

- Retail participation is 18.79 percent, increased by 1.1% YoY and increased by 0.38% QoQ.

- The total number of shareholders has increased by 245.2% to 35,435 from 27,408.

Oriental Rail Share Price Target 2024 to 2035

| Year | Share Price |

|---|---|

| 2024 | 330 |

| 2025 | 565 |

| 2026 | 944 |

| 2027 | 1,650 |

| 2028 | 2,852 |

| 2029 | 3,567 |

| 2030 | 4,866 |

| 2031 | 5,575 |

| 2032 | 6,654 |

| 2033 | 8,450 |

| 2034 | 8,865 |

| 2035 | 9,524 |

Oriental Rail Share Price Target 2024

The share price target of Oriental Rail is expected to witness a bullish trend in the year 2024, with the avg share price of Rs 330 in FY 24. The growth percentage for Oriental Rail shares is predicted to be positive, with an upward trend towards the end of the year due to strong quarter results.

- Make in India Initiative: Oriental Rail is getting its business expansion in various sectors like railways and the decoration sector due to the Make in India initiative. The Indian government is focusing on completing the various projects through domestic companies.

Oriental Rail Share Price Target 2025

The share price target of Oriental Rail is expected to witness a bullish trend in the year 2025, with the maximum share price Rs 565 in FY 2025. The growth percentage for Oriental Rail shares is predicted to be positive, with an upward trend towards the end of the year.

- Research and development: Oriental Rail is focusing on research and development consistently for completing their long-term projects in the given time frame. The company is working on new product development for a sustainable and durable time frame.

Oriental Rail Share Price Target 2030

The share price target of Oriental Rail is expected to witness a bullish trend in the year 2030, with the maximum share price Rs 4,866 in FY 2030. The growth percentage for Oriental Rail shares is predicted to be positive, with an upward trend towards the end of the year.

- Project Delay Problem: Oriental Rail is currently facing the project delay problem due to an inexperienced employee. The company is working to improve from this situation by providing the training to fresher employees.

Oriental Rail Share Price Target 2035

The share price target of Oriental Rail is expected to witness a bullish trend in the year 2035, with the maximum share price Rs 9,524 in FY 2035. The growth percentage for Oriental Rail shares is predicted to be positive, with an upward trend towards the end of the year.

- Economic Slowdown: Financial crises in the economy can reduce the infrastructure projects, so economic slowdown may be a risk factor in a company’s growth. The covid-19 epidemic was a complete slowdown for this industry.

Conclusion

Oriental Rail Infrastructure Limited has a vast future in upcoming years due to new train development for the future of India. The government of India has proposed a plan of 500 Vande Bharat trains and metro rail networks in various tier 3 cities of India.

The market research analyst has a positive outlook for the Orient Rail considering the strong Q2 results, future plans of the company, and market opportunity.

| Hind rectifiers share price target 2024 to 2035 | Read More… |

| Gland Pharma share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not an investment advice.