In this article, we will discuss the Spright Agro share price target for 2024 to 2035, quarter 2 result, financials, stock performance, future plans, and challenges depending on the various reports from research and brokerage firms and market research analysts.

Spright Agro Ltd. was established in 1994, and it is mainly involved in the agricultural business, trading agricultural produce. This firm draws, produces, and grows different crops, as well as manufactures and trades in agricultural produce and forest products.

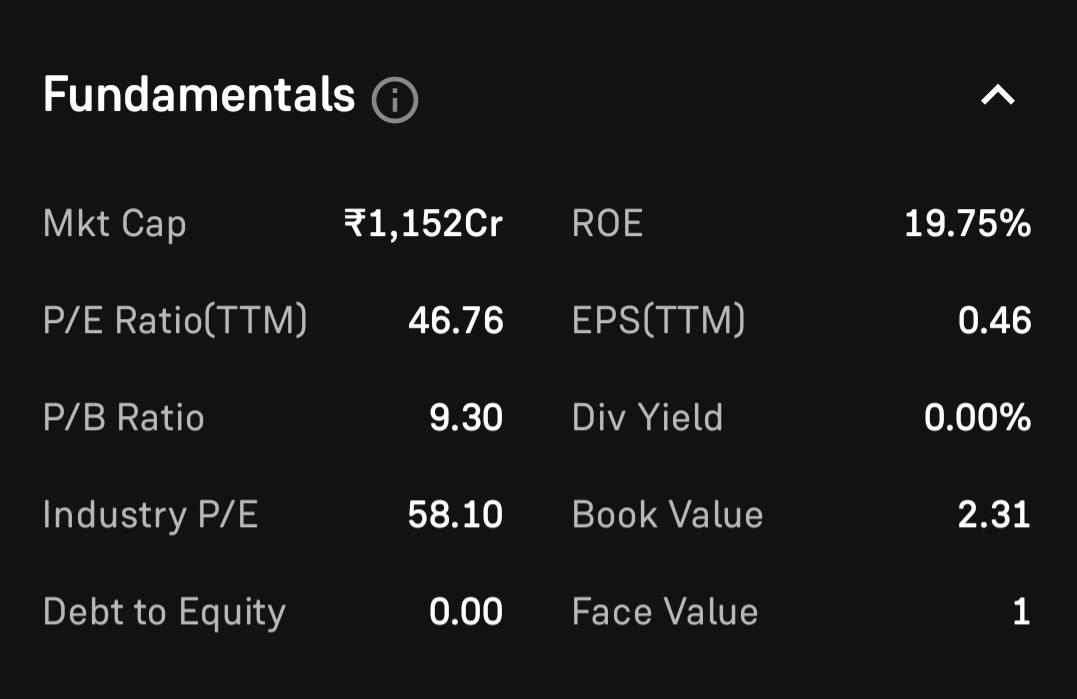

Currently, Spright Agro has a market capitalization of roughly Rs 1,152 crore and has recorded high revenue growth for the last few years.

Quarter 2 FY 2025 Results

- Net Profit: The net profit of Spright Agro during Q2 FY25 was Rs 6.96 crore, which was Rs 0.18 crore in Q2 FY24.

- Net Sales: Rs 54.03 crore (Q2 FY 2025) vs. Rs 3.12 crore (Q2 FY 2024)

The company’s net sales experienced a stupendous boost, and there is a sign of growth in sales, probably as a result of enhanced market pull or expansion.

- Expenses: Rs 47.09 crore (Q2 FY 2025) vs. Rs 2.88 (Q2 FY 2024)

Sustaining expenses fell significantly, suggesting good improvement in cost discipline, productivity, or low overheads.

- Profit Before Tax (PBT): Rs 6.98 crore (Q2 FY 2025) to Rs 2.44 crore (Q2 FY 2024).

The company realized a phenomenal rise in profitability before tax, which endorsed enhanced margins and overall financial performance.

- Earnings Per Share (EPS): Rs 0.13 (Q2 FY 2025) vs. Rs 0.90 (Q2 FY 2024)

There was, however, a reduction in the EPS, while other parameters were fairly strong. This could be because, for instance, the equity dilution is higher or other factors may be making adjustments to the shareholder’s returns.

| Q2 FY 2025 | Q2 FY 2024 | Year-over-Year Change | |

| Net Sales | 54.03 crore | 3.12 crore | +1631.73% |

| Expenses | 6.94 crore | 16.76 crore | -58.56% |

| Profit Before Tax | 6.98 crore | 0.24 crore | +2808.33% |

| Earnings Per Share (EPS) | 0.13 | 0.90 | -85.56% |

Financial

There is an overwhelming positive transformation and consequent growth rate regarding the vitality of revenues of Spright Agro Ltd. together with its progressive trends on all matters affecting profitability.

The leading player has posted net sales of Rs 54.03 crores for the September quarter for financial year 2024, and migration from a two ppt of isolated profits to Rs 6.96 crore of consolidated net profits indicates good have over the cost control operations synergies. The calculated debt-to-equity ratio of 0.0058 is still relatively low, which leads to an understanding of its advantageous pays; in particular, the value of the company’s financial structure is high; as for such an indicator as the return on equity, its value is 35.67, which shows the high level of profitability in relation to the company’s shareholder equity.

Additionally, the recent 1: There adopted single free share issue may be seen as an indication of their concentration on the concept of value for a shareholder. This is so despite today’s P/E of 48.82.

Market Cap – 1,152 crore

P/E Ratio – 46.76

Industry P/E – 58.10

Debt to Equity – 0.00

Return on Equity – 19.75%

Dividend Yield – 0.00%

Spright Agro’s 52-week high was Rs 89.32, and the 52-week low was Rs 4.85 per equity share.

Shareholding Pattern

Spright Agro has a shareholding pattern as of 30 Sep, 2024:

Retail participation is 100 percent.

The total number of shareholders has increased to 16,510 from 9,696 in Jun 2024.

Stock Performance

Spright Agro has given good returns to its investors, given below:

+24.02 percent return in the last 1 week

+45.01 percent returns in the last 1 month

+431.23 percent returns in the last 1 year

+7,735.71 percent returns in the last 3 year

+8,025.93 percent returns in the last 5 year

Spright Agro Share Price Target 2024

The share price target of Spright Agro is expected to witness a bullish trend in the year 2024, with the avg share price of Rs 25 in FY 2024. The growth percentage for Spright Agro shares is predicted to be positive, with an upward trend towards the end of the year due to strong quarterly results.

| 2024 | Share Price |

|---|---|

| Initial Target | 12 |

| Mid-year Target | 28 |

| End-year Target | 25 |

Spright Agro Share Price Target 2025

The share price target of Spright Agro is expected to witness a bullish trend in the year 2025, with the maximum share price at Rs 44 in FY 2025. The growth percentage for Spright Agro shares is predicted to be positive, with an upward trend towards the end of the year.

| 2025 | Share Price |

|---|---|

| Initial Target | 25 |

| Mid-year Target | 54 |

| End-year Target | 45 |

Spright Agro Share Price Target 2030

The share price target of Spright Agro is expected to witness a bullish trend in the year 2030, with the maximum share price at Rs 243 in FY 2030. The growth percentage for Spright Agro shares is predicted to be positive, with an upward trend towards the end of the year.

| 2030 | Share Price |

|---|---|

| Initial Target | 180 |

| Mid-year Target | 245 |

| End-year Target | 210 |

Spright Agro Share Price Target 2035

The share price target of Spright Agro is expected to witness a bullish trend in the year 2035, with the maximum share price at Rs 520 in FY 2035. The growth percentage for Spright Agro shares is predicted to be positive, with an upward trend towards the end of the year.

| 2035 | Share Price |

|---|---|

| Initial Target | 355 |

| Mid-year Target | 520 |

| End-year Target | 480 |

| Join our WhatsApp Channel for latest updates | Stockmoodys |

Future Plans

- Sustainable Farming Practices: Reduce and, where possible, eliminate dependency on fossil fuels and implement sustainable production techniques in all operations as well as with suppliers.

- Technological Advancements: Maximize the potential of sophisticated technologies and the best approaches to promote productivity and efficiency of the agricultural business.

- Expansion Plans: The proceeds from the rights issue are to be used to finance expansion that may include working capital needs and other corporate uses.

- Global Market Entry: It recommends that management should extend their markets for distributing products internationally and explore even more partnerships to increase the reach.

- Product Diversification: The company needs to launch newer products into the market, which include organic products, greenhouse technology, and modern agro-farming techniques.

- Community Engagement: Create good social outcomes within given societies by adopting meaningful partnerships and corresponding nonprofit activities.

Challenges

Despite its impressive growth trajectory, Spright Agro faces several challenges:

- Market Competition: The agriculture industry is diversified, and many players dominate the market; hence, keen competition is observed.

- Operational Costs: Some threats include Increased costs of raw material may reduce profit margins in the company, or increased transport costs may also reduce the profit margin in the firm.

- Regulatory Environment: This is a risk because changes in agricultural policies or regulations may be the cause of operational instabilities.

- Working Capital Management: The company’s working capital days, for instance, have improved from 38.8 days to 164 days, suggesting that the company may experience some cash flow problems.

Conclusion

The Q2 FY 2025 results show very impressive growth in ‘Spright Agro Ltd.’ It has well established and proved its strength that it can expand operations on a large scale. Despite the robust outlook and expansion and technology plans for the future, the company faces some issues concerning competition, the cost of operations, and working capital to enable it to maintain this rate of growth effectively.

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not an investment advice.