In this article, we will discuss the Sudarshan Pharma share price target for 2024 to 2035, fundamentals, stock performance, future plans, and challenges depending on the various reports from research and brokerage firms and market research analysts.

Sudarshan Pharma Industries Ltd. is a company engaged in the production of APIs and pharmaceuticals through trading in chemicals and solvents. A company founded in 2008, the company has grown, making baby steps or creating its base in the domestic as well as in the international markets. Key aspects of its operations include:

Product Range: The company sells a broad portfolio of products, which are APIs, specialty chemicals, and finished pharmaceuticals. The company has several products such as Jivan Kit, Setdown, Pulmo Relief, and Flupimac.

Quarter 2 FY25 Results

For the second quarter ending September 30, 2024, Sudarshan Pharma Industries reported robust financial results, highlighting significant growth in key metrics:

- Net Sales: Net sales for the company were Rs 225 crore in Q2 FY2025, down by -3.02% YoY from Rs 232 crore of Q2 FY2024.

- Expenses: Operating expenditure for the quarter was Rs 210 crore, which is lower by 5.83% YoY from Rs 223 crore in Q2 FY 2024.

- Profit Before Tax (PAT): The PAT for Q2 FY2025 was recorded at Rs 8 crore, which was up by +14.29% YoY over the PAT of Rs 7 crore for Q2 FY2024.

- Earnings Per Share (EPS): For Q2 FY 2025, the EPS was Rs 0.20 crore, down by -20.00% YoY from Rs 0.25 crore in Q2 FY2024.

| Q2 FY 2025 (Cr) | Q2 FY 2024 (Cr) | Change (%) | |

| Net Sales | 225 crore | 232 crore | -3.02% |

| Expenses | 210 crore | 223 crore | -5.83% |

| Profit Before Tax (PAT) | 8 crore | 7 crore | +14.29% |

| Earnings Per Share (EPS) | 0.20 crore | 0.25 crore | -20.00% |

Financial Performance

There has been a strong improvement in financial ratios concerning Sudarshan Pharma, especially its shares, which have risen from Rs 64.25 to Rs 419 within a short time. Such a phenomenal hike has made the company an appropriate investment target within the pharma industrial space.

The company also revealed its intent to procure more land in Maharashtra to increase capacities within production and the major potential of oncology products to affect the firm’s turnover in one year.

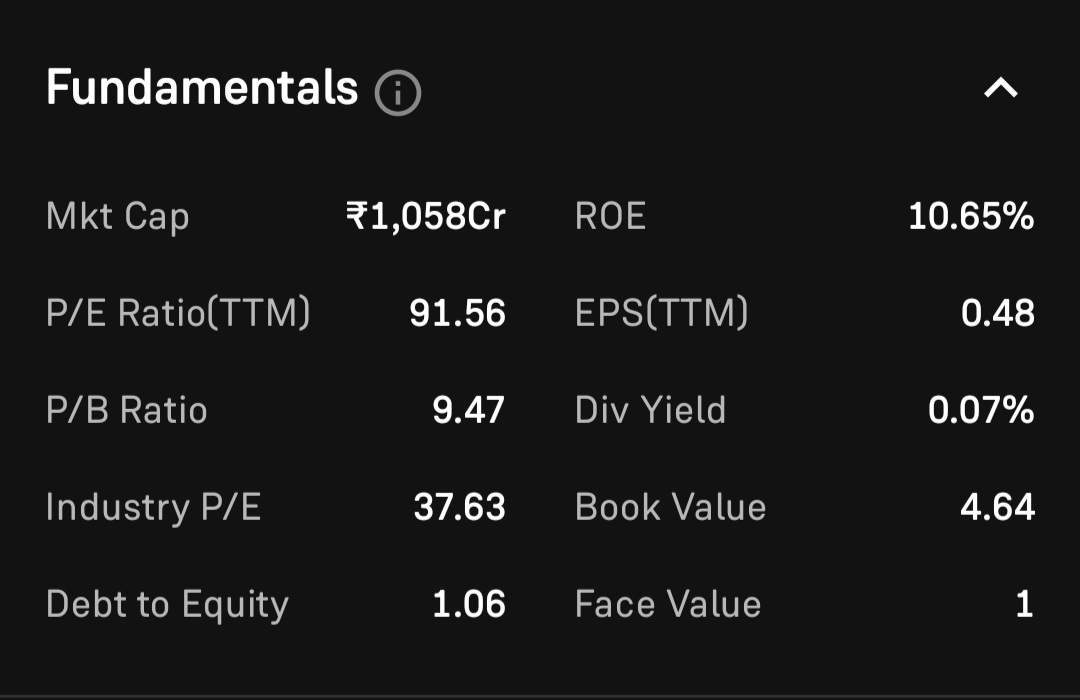

Market Cap – 1,058 crore

P/E Ratio – 91.56

Industry P/E – 37.63

Debt to Equity – 1.06

Return on Equity – 10.65%

Dividend Yield – 0.07%

Sudarshan Pharma’s 52-week high was Rs 5.82, and the 52-week low was Rs 45.27 per equity share (after adjusting for the 1:10 bonus issue).

Shareholding Pattern

Sudarshan Pharma has a shareholding pattern as of 30 Sep, 2024:

Promoter holding is 57.39%.

Foreign institutions have a 13.07 percent holding, increased by 11.67% YoY.

Retail participation is 7.08 percent, decreased by -1.36% YoY and decreased by -1.16% QoQ.

The total number of shareholders has decreased by -19.94% to 787 from 913.

Sudarshan Pharma Share Price Target 2024

The share price target of Sudarshan Pharma is expected to witness a bullish trend in the year 2024, with the avg share price of Rs 55 in FY 2024. The growth percentage for Sudarshan Pharma shares is predicted to be positive, with an upward trend towards the end of the year due to strong quarterly results.

Sudarshan Pharma Share Price Target 2025

The share price target of Sudarshan Pharma is expected to witness a bullish trend in the year 2025, with the maximum share price at Rs 103 in FY 2025. The growth percentage for Sudarshan Pharma shares is predicted to be positive, with an upward trend towards the end of the year.

Manufacturing Facilities: To meet firm production standards, Sudarshan Pharma sources its products from manufacturers certified by the FDA and WHO. It has acquired many contract manufacturing deals to increase the effectiveness of its manufacturing arm.

Sudarshan Pharma Share Price Target 2030

The share price target of Sudarshan Pharma is expected to witness a bullish trend in the year 2030, with the maximum share price at Rs 266 in FY 2030. The growth percentage for Sudarshan Pharma shares is predicted to be positive, with an upward trend towards the end of the year.

Business Model: Sudarshan Pharma is involved in the business of contract manufacturing, outsourcing, and supplying generic pharmaceutical formulations to various health care centers, government agencies, NGOs, hospitals, etc. The current company’s values entail ethical marketing, and it has made arrangements to distribute its products.

Sudarshan Pharma Share Price Target 2035

The share price target of Sudarshan Pharma is expected to witness a bullish trend in the year 2035, with the maximum share price at Rs 525 in FY 2035. The growth percentage for Sudarshan Pharma shares is predicted to be positive, with an upward trend towards the end of the year.

| Gland Pharma share price target 2024 to 2035 | Read More… |

Future Plans

The company’s future plans include:

- Expansion of Production Capacity: Sudarshan Pharma now intends to purchase land within the MIDC region to increase its production, especially in the oncology segment.

- Acquisitions: Improving the dependency on a single product, the company has recently bought a 51% controlling stake in Ishwari Healthcare Private Limited that will promote the medical and surgical instruments. Moreover, it has set up a subsidiary that concentrates on the synthesis of pharmaceutical intermediates28.

- Market Penetration: Sudarshan Pharma’s corporate strategy is to increase regional presence through product registrations and taking part in international trade shows.

Challenges

Despite its growth trajectory, Sudarshan Pharma faces challenges such as:

- Regulatory Hurdles: In the platform for pharmaceuticals, the regulatory environment is a little convoluted and often will take significant time.

- Market Competition: Pharmaceutical business is quite demanding, as there are many parties that take the value chain to be willing to have their stake in the market. Sudarshan Pharma needs to keep on improving the services it offers to its visitors in order to sustain its competitive advantage.

- Supply Chain Disruptions: Within supply chain management, the world operations can slow down production and increase prices with a negative effect on profit.

Stock Performance

Sudarshan Pharma has given good returns to its investors, given below:

+13.52 percent return in the last 1 week

+28.55 percent returns in the last 1 month

+162.72 percent returns in the last 3 months

+563.14 percent returns in the last 6 months

+455.70 percent returns in the last 1 year

| Hind rectifiers share price target 2024 to 2035 | Read More… |

Disclaimer: I am not a SEBI-registered investment adviser or research analyst. The information shared is only for educational purposes. This is not an investment advice.